Most businesses need an EIN to operate. If you’re starting a new business, getting an EIN should be at the top of your to-do list.

Think of an EIN like a social security number—but for your business.

You need a social security number to rent or buy a house, get a job, and open a personal bank account. EINs are just like that. You won’t be able to hire employees, form certain entities, or open a business checking account without an EIN.

Fortunately, getting an EIN is relatively simple. There are several different ways to do it, and you can even get an EIN for free.

Not sure if you need an EIN? Don’t know how to get one? You’ve come to the right place. This guide will walk you through everything you need to know about getting an EIN for your business.

3 Steps to Get an EIN

Getting an EIN for your business is easy and free. Just follow these quick steps below:

- Find out if your business needs an EIN

- Verify your EIN eligibility and requirements

- Apply for a free EIN

What is an EIN?

The acronym stands for “employer identification number” and is a type of taxpayer identification number (TIN). EINs get issued by the IRS to business entities like LLCs and corporations.

The primary purpose of these unique nine-digit numbers is for tax reporting. But most banks, credit card companies, and vendors will require your business to have an EIN before allowing you to open an account or working with you.

People often confuse EINs and social security numbers (SSNs) with each other, as they are both nine-digit government-issued identification numbers. But the formatting for an EIN is different from an SSN. EINs start with two digits, followed by a hyphen and then seven more (12-3456789). SSNs follow a three-two-four digit sequence, separated by two hyphens (123-45-6789).

EINs are often referred to by many different names. Here are some common synonyms for EIN that you’ll see in different contexts:

- EIN

- Tax ID number

- Federal tax number

- Federal tax ID

- Federal employer identification number

- Employer ID number

If you see any of these terms on a form, just know that they all refer to an EIN.

Step 1 – Find Out If Your Business Needs an EIN

According to the IRS, this is the general criteria used to determine if a business needs to have an EIN:

- Does the business have employees?

- Does the business operate as a partnership or corporation?

- Does the business file tax returns for employment, excise, or alcohol/tobacco/firearms?

- Does the business withhold taxes (other than wages) paid to non-resident aliens?

- Does the business have a Keogh plan?

- Is the business involved with certain trusts, IRAs, Exempt Organization Business Income Tax Returns, estates, real estate mortgage investment conduits, nonprofit organizations, farmers’ cooperatives, or plan administrators?

If you answer “yes” to any of these questions, the IRS says you need to have an EIN. However, it is important to note that a business of any size, even a single-member LLC, can get an EIN.

Let’s take this one step further and look at the EIN requirements for different entity types. Keep in mind, just because you’re not required to get an EIN doesn’t mean you shouldn’t.

Sole Proprietorships

Sole proprietorships without employees are not required to obtain an EIN if they answer “no” to all of the other criteria listed above. Any sole proprietor with employees is required to get an EIN.

In many cases, sole proprietors will still need an EIN to open a bank account or do other business-related tasks (even though the IRS doesn’t require it). Without an EIN, sole proprietors are forced to use their personal SSN on 1099 forms and other business documentation, which ultimately exposes your risk to identity theft.

Single-Member LLCs

Single-member LLCs without employees are not required to get an EIN. Again, this is under the assumption that the LLC does not meet any other IRS criteria (such as excise tax, Keogh plans, etc.). Any single-member LLC with employees is required to obtain an EIN.

Similar to sole proprietorships, it’s still recommended that you get an EIN for your single-member LLC, even though the IRS does not technically mandate it.

Partnerships and Multi-Member LLCs

If your business is structured as a partnership or multi-member LLC, you are required to obtain an EIN.

You’ll have to file a partnership return and provide K-1 tax forms to all members of the LLC. You must have an EIN for this type of reporting and entity structure.

Corporations

The term “corporation” can refer to several different entity types. The most common entity types are S corporations, C corporations, and nonprofits, all of which are required by the IRS to have an EIN for tax purposes.

In short, if you are incorporating your business, you need an EIN.

Trusts and Estates

In some instances, EINs are used for certain types of trusts and estates. But for the purposes of this guide, we’ll stick to diving into EINs for businesses only.

Step 2 – Verify Your EIN Eligibility and Requirements

Now that you understand who needs an EIN, what they’re for, and why you need one, there’s one more thing to know before you apply. Just because you need an EIN doesn’t necessarily mean that you’re eligible to get one (but most people are).

According to the IRS, these are the eligibility requirements for obtaining an EIN:

- Your business is located in the US or within a US territory

- The applicant must have a valid taxpayer identification number (usually their social security number)

- Each responsible party is limited to one EIN per day

A “responsible party” is defined as the person who owns or controls the entity (a natural person, not an entity).

Reasons to Get an EIN For Your Business

Aside from the government mandates, there are other reasons why you should get an EIN. So, for those of you who fall into the “not required” categories, here are some other scenarios where an EIN might be necessary:

- Opening a business banking account (most banks will require an EIN)

- Building business credit to qualify for loans

- Protecting you from identity theft (instead of using your SSN for business purposes)

- Applying for a business credit card

- Applying for a business line of credit

- Applying for certain business licenses

- 1099 forms (instead of SSN)

- Establishing credibility as a freelancer or independent contractor

- Establishing trust with new vendors

- Avoiding tax penalties

- Having more options for retirement plans

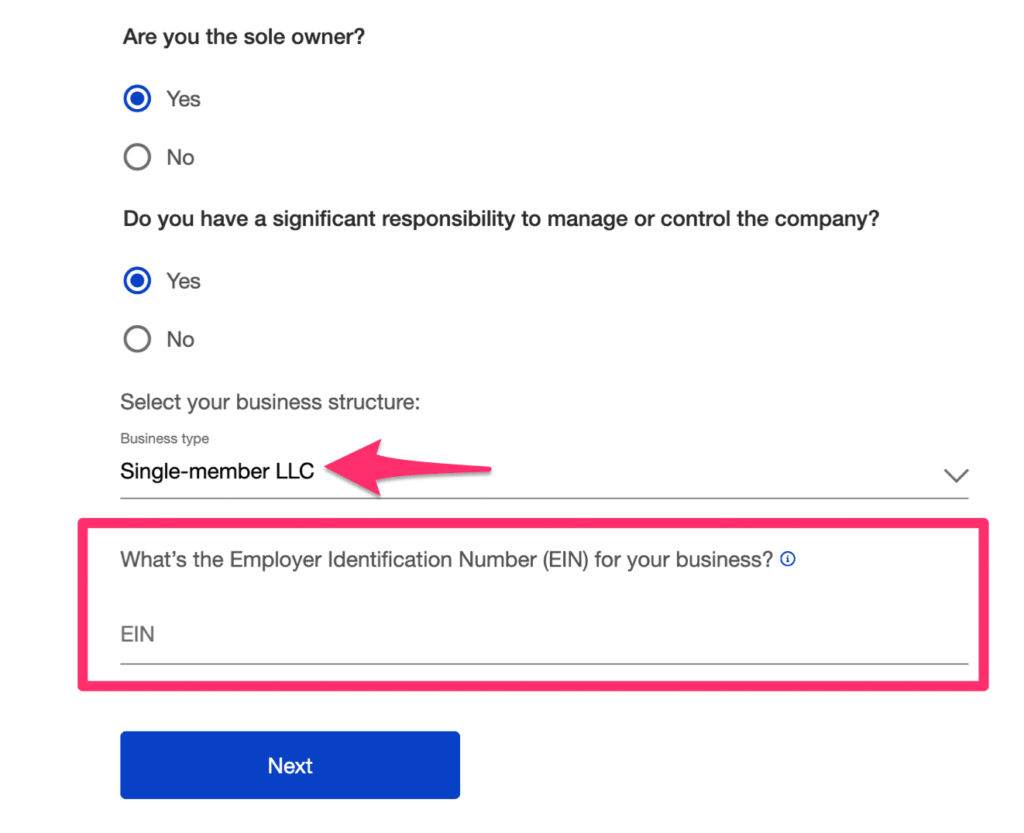

As you can see, EINs go far beyond tax requirements. Remember when we said that a single-member LLC is not always required to have an EIN? Take a look at this business checking application from US Bank:

In this case, you wouldn’t be able to open a business bank account without an EIN. This means you can’t separate your personal expenses from business expenses, which may lead to a completely new set of problems down the road.

Getting an EIN from the beginning (even if you don’t actually need one) can also help your business grow in the future.

For example, let’s say you’re currently a sole proprietor and handle all business operations on your own. But you start to get more work and need to hire an employee.

You won’t be able to legally hire anyone until you obtain an EIN. Rather than waiting and potentially encountering delays in the process, it’s better to be proactive and get an EIN while you’re setting up your business entity. This way, you’ll be able to hire people when you’re ready without having to take extra steps.

Step 3 – Apply For a Free EIN

Applying for an EIN is easy. You can apply directly with the IRS to get a free EIN, using one of the following methods:

- Online

- By fax

- By mail

- By phone (international applicants)

Apply Online

Applying online will be the best option for the vast majority of people. Click here for the application link on the IRS website. It’s free, and it won’t take up too much of your time.

The IRS requires that you complete the application in one sitting. So, you can’t start, save your progress, and then finish at a later time. Your session automatically expires after 15 minutes of inactivity. If this happens, you’ll need to start over.

I like the online application because it’s so straightforward. You just have to provide some basic details about your business, including:

- Legal structure (sole proprietor, partnership, LLC, corporation, etc.)

- Member information

- State or territory where the business is physically located

- Reason for applying (to hire employees, banking purposes, new business, etc.)

- Information about the “responsible party” (you, in most cases)

You can apply online during business hours from 7 a.m. – 10 p.m. EST, Monday through Friday.

You’ll receive your EIN immediately after the application has been verified, and can use it to open a bank account or apply for a business license right away.

However, it takes up to two weeks for the EIN to become an official part of the IRS’s records. You won’t be able to file an electronic tax return or make an electronic tax payment until it is in their official records.

Apply by Fax

For those of you who can’t or don’t want to apply online, you have the option to send your application via fax. You’ll need to print and complete IRS Form SS-4.

This form is available online and there are no time constraints for when you can send the fax (unlike the online form).

Make sure you read the form carefully. If you answer something incorrectly or make a typo or error, it can cause significant delays in the process. Error-free forms generally take about four business days to process.

If you’re located in one of the 50 states or Washington DC, send the fax to 855-641-6935. For those of you without a legal residence, principal office, or principal agency within the US states, fax Form SS-4 to 855-215-1627 (within the US) or 304-707-9471 (outside the US).

Apply by Mail

A mailed application will take the longest to process. But if you’re not in a rush, you can print and complete Form SS-4 and send it to the following address:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

The mailing address remains the same regardless of your physical location. However, if you don’t have a legal residence or a principal address in the US, change the attention line to “Attn: EIN International Operation” instead.

Apply by Phone

If you’re applying for an EIN and your business is located outside of the US, you cannot apply online. You must call the IRS directly to obtain an EIN as an international applicant.

This option is ONLY available to international applicants. The IRS does not take phone applications for businesses physically residing in the US anymore.

To apply for an EIN by phone, call 267-941-1099 between 6 a.m. and 11 p.m., Monday through Friday (the number is not toll-free).

Alternative Ways to Get an EIN (Employer Identification Number)

For those of you launching a new business, you have another option for obtaining an EIN.

In order to officially start your business, you need to file the appropriate documents with your state, name a registered agent, and go through some additional formalities. Many people choose to use a business formation service for this. These online services will handle all of the appropriate filings on your behalf, regardless of your entity type.

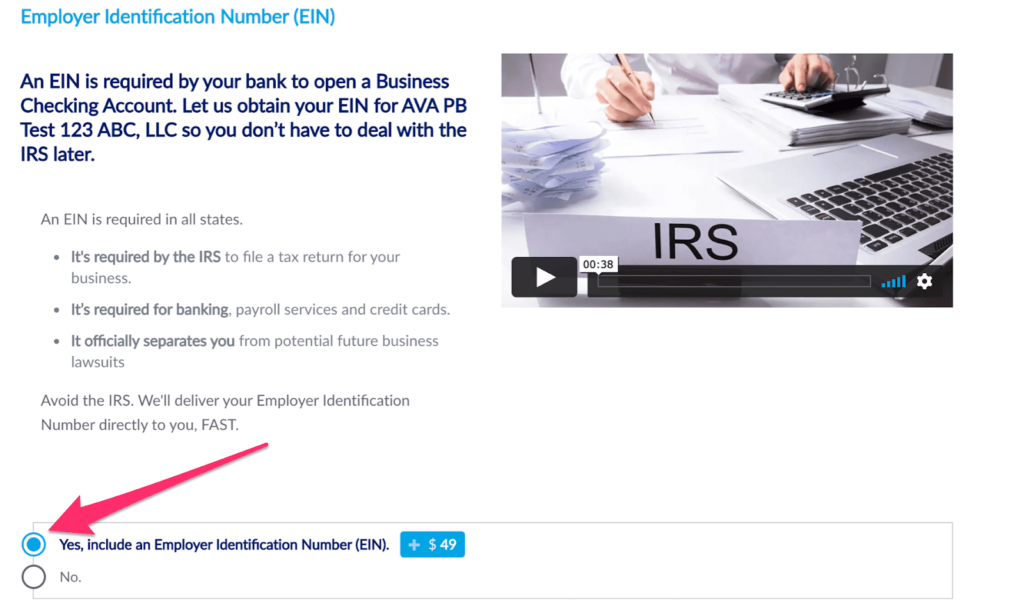

While signing up for a business formation service, you can easily add an EIN filing option to your plan. The provider will obtain one from the IRS on your behalf using the same information you’re providing to form your LLC or corporation.

There’s usually an added, one-time fee for this service, but you’re paying for convenience. It’s as simple as checking a box and letting a third-party handle the rest for you.

Here’s an example from Inc Authority (a popular business formation service):

Adding an EIN to your order will look a little different, depending on the formation service you use. But everyone offers one, and it’s easy to select when you’re signing up. Some business formation service plans will even include an EIN in your package.

How Much Does an EIN Cost?

Applying for an EIN is 100% free—as long as you apply directly through the IRS. The four methods discussed earlier in this guide (online, fax, mail, phone) are all free for anyone.

If you use a third-party service, there’s usually a charge on top of the business formation base cost. Here’s a list of EIN prices from the best business formation services on the market today:

- LegalNature — $70

- Incfile — $70

- LegalZoom — $60 (part of an upgraded add-on package)

- RocketLawyer — $59.99

- ZenBusiness — $99

- Inc Authority — $49

- Incorporate.com — $80

- Swyft Filings — $70

- MyCompanyWorks — $49

- Northwest Registered Agent — $50

- MyCorporation — $79

These are the current base rates for obtaining an EIN from those providers. In some cases, EINs will come included in certain formation plans or premium packages.

Conclusion

Employer identification numbers (EINs) are required for many businesses to operate. Even if your particular business isn’t required by law to obtain an EIN, it’s still in your best interest to get one.

How do you get an EIN? It’s easy—just follow the instructions in this guide.

Getting an EIN from the IRS is free and easy. But if you don’t want to deal with the IRS, you can always use a business formation service and let them handle the application on your behalf.